Day-Trading the Non-Farms Payrolls (NFP) Report

Feb 14, 2024 By Triston Martin

What is the Non-Farms Payrolls (NFP) Report?

The Bureau of Labor Statistics releases the NFP report monthly to reflect how the US employment scene has changed. This excludes employees from non-profit organizations, the government, private household employees, and farm workers.

You can imagine how such news will cause waves in the stock market. Every first Friday of the month at 8:30 AM ET, analysts, investors and traders are on their toes awaiting the NFP number.

If the report states that the numbers have increased, it means that the economy has expanded. The vice versa is true. High numbers may automatically cause the US dollar's value to become stronger, while low numbers will weaken the dollar. However, high numbers may not accurately indicate good things ahead; it could be a sign of inflation.

The NFP report is convenient and reliable as it is always released monthly. It is a useful indicator of how quickly or slowly the job market swings. A revision of the previous month's data is also released alongside the report.

Relying on the NFP report can be very dangerous, as trading in them could be very volatile. While some investors will profit from the swings caused by volatile stocks, more risk-averse traders prefer to keep their distance.

How to trade the NFP Report

This is the golden rule while trading Non-Farm Payroll report data: don't trade based on the numbers (alone). When the number of jobs changes and is reflected in the report, the dollar and currency pairs – such as EUR/USD, will move automatically, whether increasing or decreasing. Again, volatility.

When the NFP numbers are good, you can trade based on these figures and get good money. What causes the discrepancy? It's all about being vigilant and careful when trading.

We advise you on what you could do to better your odds of making profits with the NFP report:

- Consider estimates by analysts

- Consider the technical patterns of the asset

- Have a bigger picture

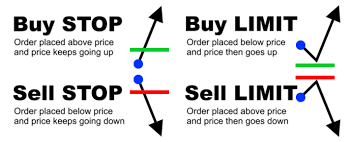

- Consider using limit orders, such as buy and sell stops and buy and sell limits.

When trading on the stock market, always remember that some investors will use complex software and equipment to help them make better decisions. Invest in software, or use the freely available software that gives you insight into the best strategy.

OCO Order

A strategy that traders can use when trading is an OCO order, meaning 'One Cancels the Other.' It consists of two conditional orders that are distinct but connected. If the conditions of one order are met, this is the green light for it to be executed. This means that the other order is automatically cancelled.

This strategy is a win-win situation because it banks on either of the two situations being executed. If one fails, the other is executed. Traders will have nothing to worry about while using an OCO order because their investment is safe either way.

Breakout strategy

Another strategy to use when trading NFP is by using a breakout strategy. The trader will need to set a specific range close to the price of an asset, such as two hours before the NFP report is released. They will then enter a short or long position if the price breaks out of this predefined range.

You can use the OCO order to determine whether you will sell or buy and execute the former if the lower limit is broken. You could settle to buy if the upper limit is broken.

Wait and see

Most traders will prefer to use this strategy while trading the NFP. Wait and see is a prudent strategy used especially by beginners and risk-averse traders. Some traders will choose to stay away from the market entirely when the NFP report is released.

Experts advise that you wait till the news announcement is out. It is then best to trade when the spread narrows. If the price has moved at least 15 pips within the last two hours, then trade the 1-minute chart. If not, save your money.

There is a big benefit to this strategy. Traders will watch the news and analyses, then make an informed decision about how best to invest. However, especially if it was a positive upturn, they may miss out on huge profits and settle for whatever is left in the market.

Choose only two trades.

Caution is to be placed here:

- Don't be too greedy.

- If this is your strategy, select two trades at a maximum.

- Do not re-enter if both trades get stopped out.

Trade on a demo account first.

It is advisable to put your trading skills to the test on a demo trading account first before launching into the deep waters. You can get such tests free on the internet. The software creates a virtual feel of what the market would be like if the NFP were released today.

It allows you to put your skills and preferred strategy to the test and see the results. This will then advise you on what you should retain and eliminate.

The process of day trading the NFP report.

Immediately after the NFP report is released, the first few minutes involve a behemoth of activities. Analysts and traders will scan the report to determine which currency they should purchase. The report's data may be wordy and lengthy, so it pays to have some experience day trading the NFP.

For instance, traders may conclude that the dollar will be stronger than the euro based on their interpretation of the report's data. They could have noticed that the non-farm workers' payroll has increased compared to last month.

This would mean that since the dollar's value is high, it is projected to increase so that traders will purchase more dollars. If the NFP report claimed otherwise, the euro's value would skyrocket, and everyone would clamour for it.

Day traders will wait first before making their positions and trading. Day traders will take long positions if currency traders begin buying dollars. Conversely, they will take short positions if currency traders buy euros.

Now that you have the necessary information to get you started, happy day trading!

How to Check Your Credit Card Application Status

Dec 01, 2023

Get the help you need to know your credit card application status! Find out what steps you should take and how to make sure the process runs smoothly.

The Best Money Saving Tips for Singles

Mar 15, 2024

Are you a single person finding it difficult to manage your expenses and save money? This guide has got you covered on the best money saving tips that you should know

Adding Stimulus Money on Your Tax Returns

Dec 17, 2023

Do you want to explore the fundamentals of adding stimulus money to your tax return? Do give this guide a thorough read.

Credit Cards Annual Fee

Nov 11, 2023

There are several circumstances in which it does not make economic sense to pay an annual fee for a credit card. There is no shortage of credit cards that do not charge an annual fee.

The Fast and the Refund-ious: A Guide to Claiming Your Tax Refund Quickly

Mar 18, 2024

Get your tax refund fast and furious with our ultimate guide! Claim what's rightfully yours with ease and speed; no Vin Diesel required.

Methods Of Debt Consolidation How Does Debt Settlement Work

Feb 19, 2024

Individuals can settle their debt by making a one-time payment to a creditor in return for the cancellation of some or all of their debt. To effectively negotiate a debt settlement plan, you must cease making the monthly minimum payment on that debt. These payments will accrue late penalties and interest, negatively impacting your credit score.

Exploring the Top 9 Low-Cost Brokers of 2024: A Complete Review

Mar 15, 2024

Explore the top 9 low-cost brokers of 2024, from Fidelity Investments to Acorns, and make intelligent investment decisions with ease

Top Paying Annuity Rates

Dec 23, 2023

The annual growth rate of an annuity, expressed as a percentage, determines how much money will be received from the annuity each year. The insurance company or other financial institution issuing the annuity contract determines the rate. The payout rate of an annuity is the annual percentage rate at which the principal sum of the annuity is distributed to the beneficiary each year.

Closing Costs In New York: All You Need To Know

Feb 06, 2024

Unsure about closing costs when buying or selling property in a city that never sleeps? Know about Closing costs in New York in this article.

8 Must-Know Aspects of the Tomo Card: A Comprehensive Guide

Feb 01, 2024

Explore the revolutionary Tomo card, a digital banking solution offering user-centric services, multi-account integration, low fees, and effective financial management tools.

Comprehensive Guide to Bad Debt: Write Offs and Estimation Methods

Dec 29, 2023

Struggling to manage bad debt? Learn how to estimate and write off bad debt to help you have a better financial outlook.

Home Appraisal Costs, Uses, and What to Expect

Dec 09, 2023

A home appraisal is an important part of any real estate transaction, as it evaluates the market value of a property. It takes into account factors such as location, age, condition and size, as well as recent upgrades or renovations. A variety of types of appraisals exist for different types of transactions, such as relocation appraisals or investment property appraisals.