Find Out: How to Calculate PV of a Different Bond Type With Excel?

Dec 22, 2023 By Triston Martin

Introduction

To borrow money from an issuer and pay it back to the holder is the essence of a bond (the purchaser of a bond). At maturity, the issuer must refund the borrowed "par value" (i.e., when the contract ends). This loan provides the holder with coupon payments based on the annuity formula's payout schedule. These financial payments are considered interest by bondholders but a cost of borrowing by the issuer. To calculate a bond's present value (PV), we add up all of the cash flows we expect from the bond between now and when it matures, and we get our original investment back (the par value). This means that we can use a Microsoft Excel spreadsheet to calculate the present value of a bond with a set principle (par value) that will be repaid at some point in the future.

Method for Determining the PV of a Bond of a Different Type

The bond's financial viability depends on the yearly interest rate, the time horizon (how long until the bond expires), and the interest rate. Whether or whether you need the bond's total face value upon maturity is unimportant.

Interest-Free Bonds

Think about a zero-coupon bond that is $1,000 and matures in 20 years. As the bond's value has declined since it was issued, a 5% discount rate is currently offered by the market to buyers. Here are the steps to take to determine the bond's current value:

The term "rate" here refers to the annual percentage yield on the bond's face value. The interest on this bond is compounded by a "Nper" number of times, where N is the number of compounding periods. The bond we issued will mature in 20 years. The "Pmt" notation stands for the coupon's periodic payment of the face value times the number of periods till redemption. Not much to see. Its "Fv" value represents the bond principal fully repaid on its maturity date. The bond is now trading at the market price of $376.89.

Fixed-Interest Bonds

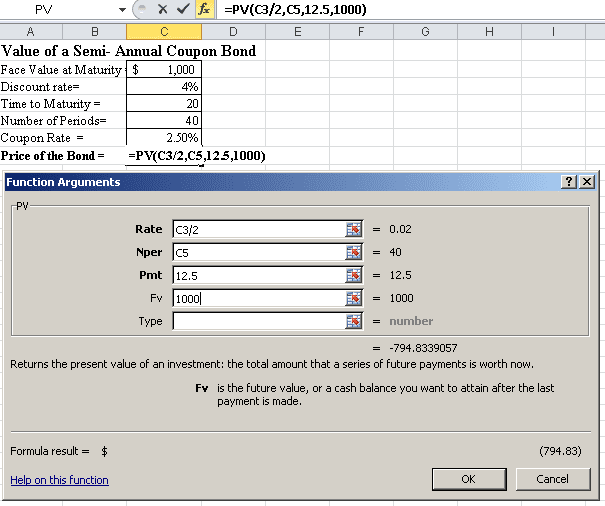

This bond from Company 1 is for $1,000, has a discount rate of 4%, a 20-year maturity, a 2.5% coupon rate, and a discount date of today. The bond's annual coupon is $25. (0.025 multiplied by 1000). The value of "Pmt" in the Function Arguments Box is $25. This bond has a present negative value; hence its purchase would cost the buyer a negative $796.14. In this case, the cost of such a bond would be $796.14.

Purchasing Bonds That Pay Interest Twice a Year

A $1,000 face value, 2.5% annual coupon, 20-year maturity, 4% discount, and issued by Company 1. Coupons for this bond are issued annually at a rate equal to $0.0250 x 1000 x $25 x $25 x $12.50. 1.25% (=2.5% 2) is half a percentage point more than twice a year. Since there are 40 6-month intervals throughout a full two decades, "Pmt" is set to $12.50, and "nper" is set to 40 in the Function Arguments Box. At this time, purchasing one of these bonds would result in a loss of $794.83. This bond kind has a price tag of $794.83.

Infinite Compounding Bonds

Continuous compounding occurs when interest is applied to itself at set intervals. We have seen several different options for compounding frequency, including annually, semiannually, and monthly. However, there is no maximum number of compounding periods in continuous compounding. The cash flow is discounted at an exponential rate.

Underhanded Costs

When calculating a bond's "clean price," interest accrued on coupon payments is ignored. When a bond first enters circulation, its price is determined by the primary market. The secondary market price of a bond should reflect the accrued interest since the last coupon payment. The "dirty pricing" of the bond accurately describes this situation. A bond's "Dirty Price" is its Clean Price plus interest accrued. If you add up all of a bond's future interest payments and principal, you get its "Dirty Price." Interest accrued is determined by multiplying the coupon rate by the number of days since the last coupon payment and dividing by the coupon day period.

Conclusion

A convenient Excel formula can be used to price bonds. The PV function can determine the price of a bond with or without annuities and the price of a bond with annual or biannual allowances.

The Fast and the Refund-ious: A Guide to Claiming Your Tax Refund Quickly

Mar 18, 2024

Get your tax refund fast and furious with our ultimate guide! Claim what's rightfully yours with ease and speed; no Vin Diesel required.

Methods Of Debt Consolidation How Does Debt Settlement Work

Feb 19, 2024

Individuals can settle their debt by making a one-time payment to a creditor in return for the cancellation of some or all of their debt. To effectively negotiate a debt settlement plan, you must cease making the monthly minimum payment on that debt. These payments will accrue late penalties and interest, negatively impacting your credit score.

Definition of Rental Real Estate Loss Allowance

Jan 07, 2024

The amount of passive losses from real estate you are permitted to deduct from your active income annually is the rental real estate loss allowance.

Unlock the Secrets: How to Get Your Hands on Vanguard VTI Total Stock Market ETF Units

Mar 16, 2024

Discover how to invest in Vanguard VTI Total Stock Market ETF: steps, benefits, and why it's a smart choice for US market exposure

Everything You Should Know About Time to Rebalance Your Portfolio

Jan 03, 2024

Investing in the stock market can significantly grow your wealth and achieve your financial goals. However, as with any investment strategy, there are risks involved. One way to manage these risks is to rebalance your portfolio regularly

Closing Costs In New York: All You Need To Know

Feb 06, 2024

Unsure about closing costs when buying or selling property in a city that never sleeps? Know about Closing costs in New York in this article.

All About a Mortgage Accelerator Loan

Jan 25, 2024

Several other factors must be taken into account before settling on a course of action. For instance, if you prioritise paying off your mortgage over saving for retirement or college for your children, you might lose out on more money in the long run by neglecting those other goals.

A Guide to Duty-Free Shops – Do They Help You Save Money?

Mar 15, 2024

Heard about duty-free shops helping you save money but did not know what these shops are and where you can find them? This article has you covered

Everything You Need To Know About Student Loan Deferral

Oct 02, 2023

Find out how student loan deferral affects your credit score, and see if you can get one. You'll also learn the benefit of getting a deferral and how to go about it.

How to Pay Off a Mortgage More Quickly

Dec 04, 2023

Mortgages are long-term loans that people get to finance real estate acquisition. A mortgage is a substantial financial commitment that might endure for decades, but it also makes it possible for people to become homeowners. Some homeowners may need help with the standard 30-year mortgage term.

Navigating Your Options: An In-Depth Review of HSBC Personal Loans

Feb 03, 2024

An informative guide on HSBC personal loans, covering interest rates, application steps, benefits, and potential drawbacks.

Day-Trading the Non-Farms Payrolls (NFP) Report

Feb 14, 2024

The Non-Farms Payrolls report is one of America's most anticipated news announcements. It provides economists with a picture of how well the economy is doing in terms of employment or otherwise. How can day traders take advantage of this opportunity and trade the NFP report?